After a period of infatuation, promise fatigue and changing geopolitics have led to policy changes from Vilnius to Bucharest. This has coincided with the PRC’s changing geopolitical standing — now needs to factor in China’s “systemic rivalry” with the EU and rising tensions with the U.S. and other democratic countries.

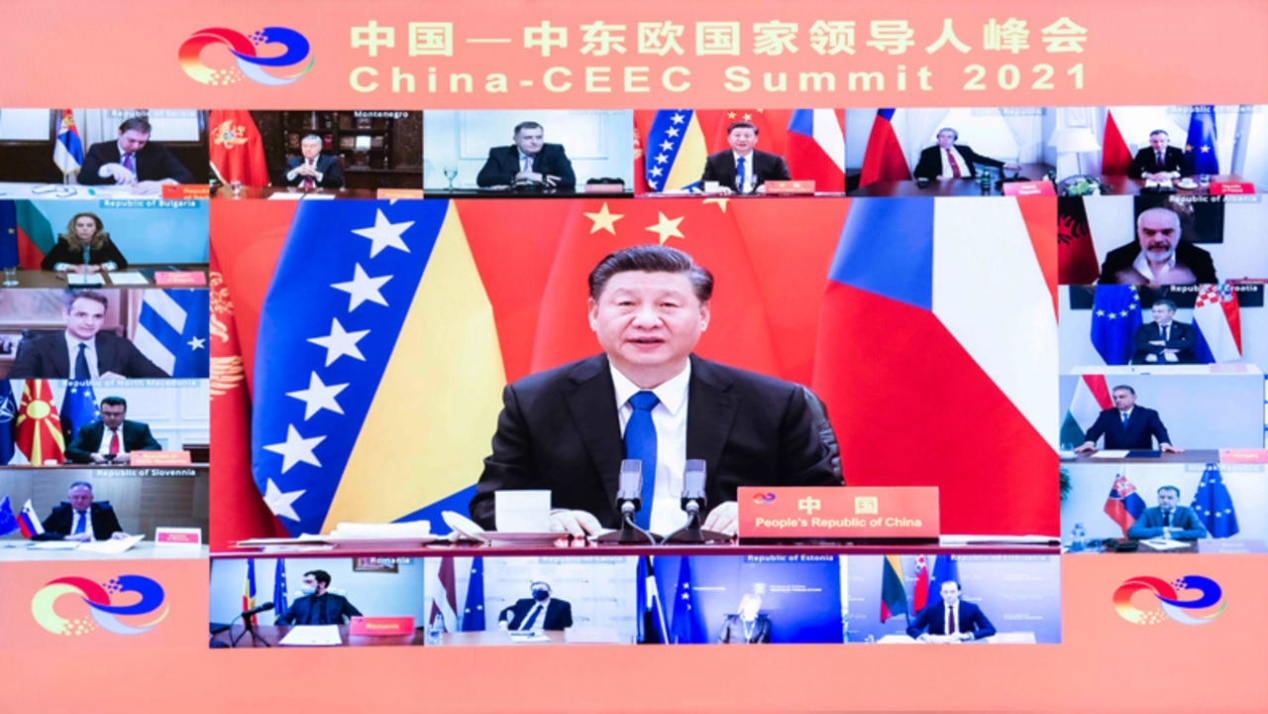

Picture source: 李濤, February 9, 2021, People.cn, http://politics.people.com.cn/BIG5/n1/2016/1106/c1001-28838339.html

Prospects & Perspectives 2021 No. 41

Waking up from the China Dream in Central and Eastern Europe

By Martin Hála

August 2021

After a period of infatuation, promise fatigue and changing geopolitics have led to policy changes from Vilnius to Bucharest.

In 2012, a summit was held in Warsaw that gave rise to the so-called 16+1 grouping (enlarged to 17+1 in 2019, then reduced back to 16+1 this year). The “initiative,”officially called China-CEE Cooperation (中國-中東歐國家合作) was — or so it seemed at that time — a masterstroke of Chinese diplomacy. The People’s Republic of China (PRC) had effectively regrouped the old East European “bloc” dominated before 1989 (with the exception of the Western Balkans) by the Soviet Union, bringing together all the countries in the region (minus Kosovo, which is not officially recognized by China), including the three Baltic Republics. The initiative herded together both EU member and non-member states and redivided Europe again into the “East” and “West” —- almost as if 1989 had never happened.

Catching up with the West’s Failing Engagement

In retrospect, the Chinese re-enactment of Eastern Europe may look like a striking diplomatic breakthrough, but in the context of the day, it appeared less extraordinary. This was the time just before Xi Jinping’s accession to power. Closer economic cooperation with the PRC was generally considered a no-brainer that promised much benefit and carried little risk. China was still mostly seen as an essentially benign power, and since the 2008 financial crisis, one that was offering a way out of the global economic malaise. In Europe, the global financial crisis was followed by the fiscal crisis of the Eurozone, and many on the shaken continent pinned their hopes on Beijing.

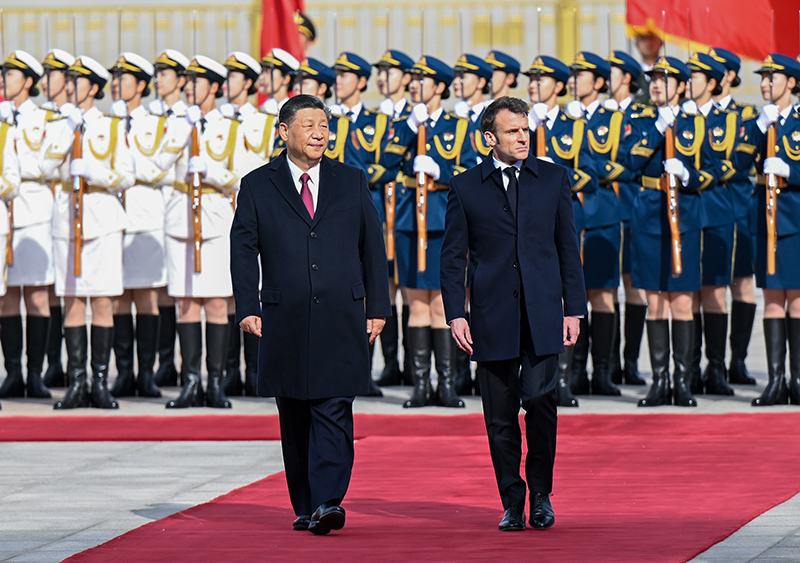

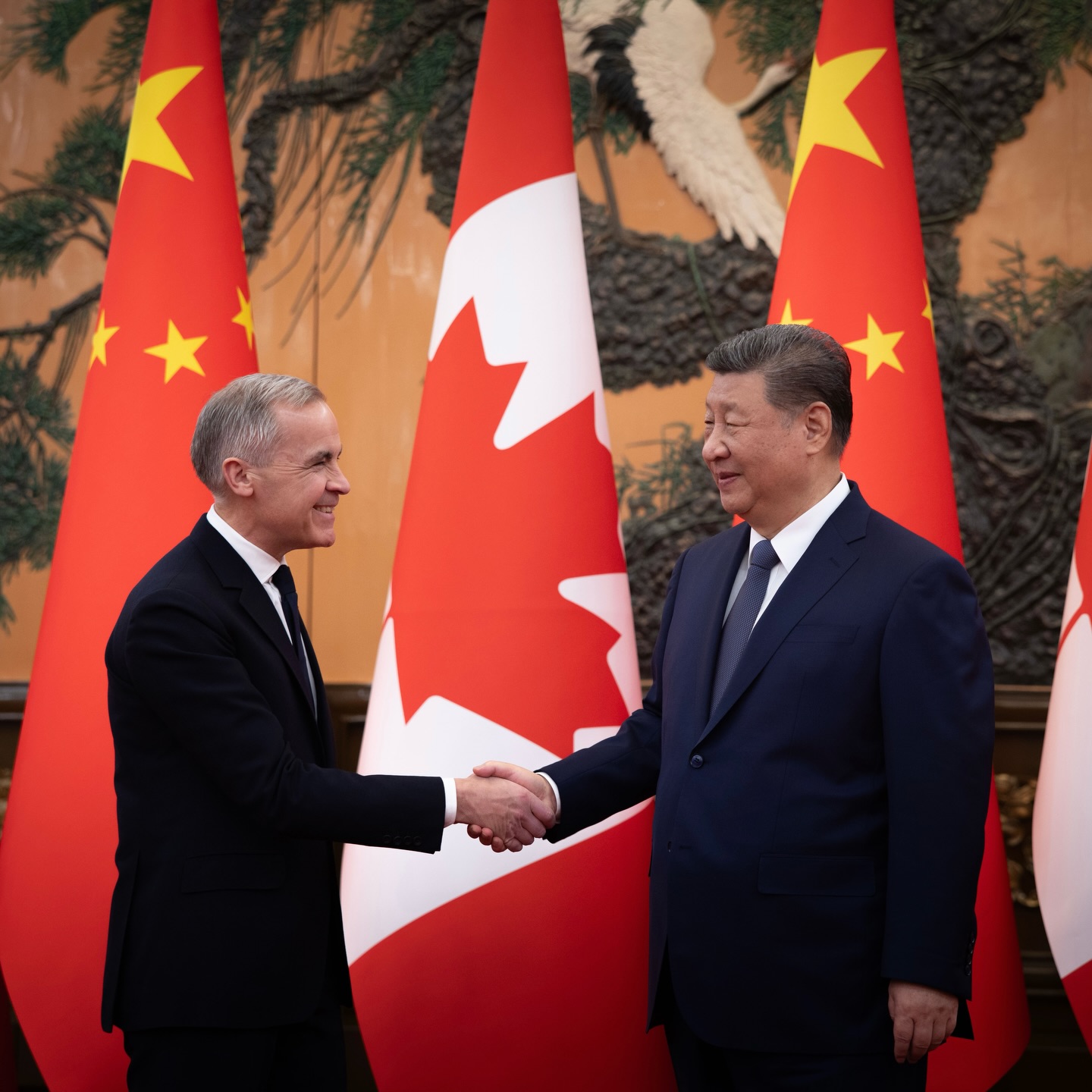

In Washington, the “Engagement” policy still carried the day, as did (some might argue still does) the Wandel durch Handel (Change through Trade) in Germany. To put things in perspective, we only need to remember that these were the years of the “Golden Era” in the UK’s relations with China, and the CEE leaders could perhaps be excused if they believed (had they spared a thought on it) that they were not exposing themselves to Beijing any more recklessly than David Cameron or George Osborne.

Some CEE public figures had, in fact, argued in exactly those terms. The one politician arguably most enthusiastic about the new horizons in Beijing, Czech President Miloš Zeman, explicitly cited the UK and German examples of courting China, claiming he was only trying to catch up with the West in order not to be left behind in the global scramble for Beijing’s attention.

Again, looking back we might conclude that this was a rather poor timing to try and catch up with policies in the West that were about to start crumbling. Back in 2012-13, however, few had the foresight to predict the upcoming tectonic shifts.

Waiting for the Chinese Investments

The grand narrative behind the foreign policy reorientation towards the PRC in the CEE after 2012 was “economic diplomacy,” marketed as a much needed policy correction to accommodate the new geopolitical reality of a rising China awash in cash. The EU members in the region, and to some extent even the non-member states, had benefitted from the massive EU structural and cohesion fund inflows, but the new wisdom had it that these cash injections would dry out, eventually, given the Eurozone crisis, and just might be replaced by equally if not more massive future investments from the PRC.

Expectations ran high. After Xi Jinping’s visit to Prague in March 2016, President Zeman announced that just within that same year, cumulative Chinese investments would reach 100 billion Czech crowns (CZK). He apparently arrived at this figure by summing up the declarative value of all the MoUs signed during the visit. Not surprisingly to anybody familiar with Chinese business practices, very few of those saw any follow up, and a year later the overall value of Chinese investments was calculated by the Czech Statistical Bureau at around 2 billion CZK, or about 2% of Zeman’s star-eyed figure.

The situation hasn’t been much different throughout the region, certainly among the EU member states. “16+1” has not led to significant increase in Chinese investment which, despite all the rhetoric of “special relationships” and “gateways to Europe,” remains a fraction of the Chinese investment in Western Europe. There has been some increase in investment in the Western Balkans that mostly remains outside EU membership and the cohesion funds that come with it. But even there, Chinese investment projects often invite controversy, like the shocking corruption allegations in Macedonia, or the apparent debt trap resulting from the Chinese-built “highway to nowhere” in Montenegro. Trade with China has increased through the region, but so has the trade imbalances in favor of the PRC.

Frustrated Expectations and Changing Geopolitics Force a Reassessment

After years of frustrated expectations, the promise fatigue eventually started to register throughout the region, with the possible exception of pro-Beijing stalwarts like Serbia and Hungary. This has coincided with the PRC’s changing geopolitical standing — unlike in the old days of “Engagement,” “economic diplomacy” with the PRC now needs to factor in China’s “systemic rivalry” with the EU and rising tensions with the U.S. and other democratic countries. The “Wolf Warrior” diplomacy and gross human rights violations in Xinjiang, Tibet and Hong Kong did nothing to maintain the facade of “win-win,” “mutually beneficial” relations.

Perhaps nowhere have the fallacies of China’s economic diplomacy been exposed more starkly than in the Czech Republic, where the new“strategic relationship”had been dominated for a few short years by a single Chinese company, CEFC (中國華信). The company was hailed as the “flagship of Chinese investments” in the country, and its chairman, Ye Jianming, was named the Czech President’s advisor in 2015. The Czech branch of the company, CEFC Europe, managed to put a number of high-ranking Czech civil servants and politicians, including a former Czech Euro-Commissioner, on its payroll, before it collapsed spectacularly in 2018. Ye, the Czech president’s Chinese advisor, was unceremoniously disappeared by the Chinese Communist Party disciplinary apparatus, while the representative of its “non-profit wing,” Patrick Ho Chi-ping, was sentenced before a federal court in the U.S. for large-scale political corruption in Africa and in the highest echelons of power in the U.N.

It was embarrassing incidents like this, together with the overall “promise fatigue” and the changing geopolitical situation, that led to a partial reassessment of the region’s relationship with China. Lithuania, under a new center-right government, is leading that process, first organizing a joint Baltic semi-boycott of the 17+1 virtual summit earlier this year, and then withdrawing from the “initiative” altogether. Other countries like the Czech Republic, Slovakia and Romania might soon follow suit. Only the increasingly authoritarian Hungary and Serbia are doubling down on their “steely” friendship with China.

With the sobering up from the China infatuation comes a new re-appreciation of Taiwan, which brought some real, productive investments into the region after 1989. Foxconn set up production lines in the Czech Republic in the 2000s that have established whole new industries, and became the second-largest exporter from the country. That record was, for a while, obfuscated by the barrage of PRC’s “economic diplomacy.” The superficial argument had prevailed that China is big and Taiwan is small, and the potential for economic cooperation “naturally” follows that basic logic.

With the new global trend of supply chains restructuring, Taiwan’s New Southbound Policy, and other recent developments, some CEE countries now begin to realize there might be fresh opportunities for them to attract Taiwanese investment and know-how in strategic sectors like semiconductors. Given that the “supply chain restructuring” is very much driven by geopolitics, including security concerns, this new outlook — if and when fully internalized — might soon reshape even further the region’s approach towards both the PRC and Taiwan.

(Dr. Hála is Sinologist with Charles University in Prague, Founder & Director of project Sinopsis.cz)