With growing skepticism of China after Russia’s aggression in Ukraine, the failure of the 16+1 and the positive momentum at the EU, regional and global level, Taiwan has a unique window of opportunity to advance long-term relations with the V4 and the broader CEE region.

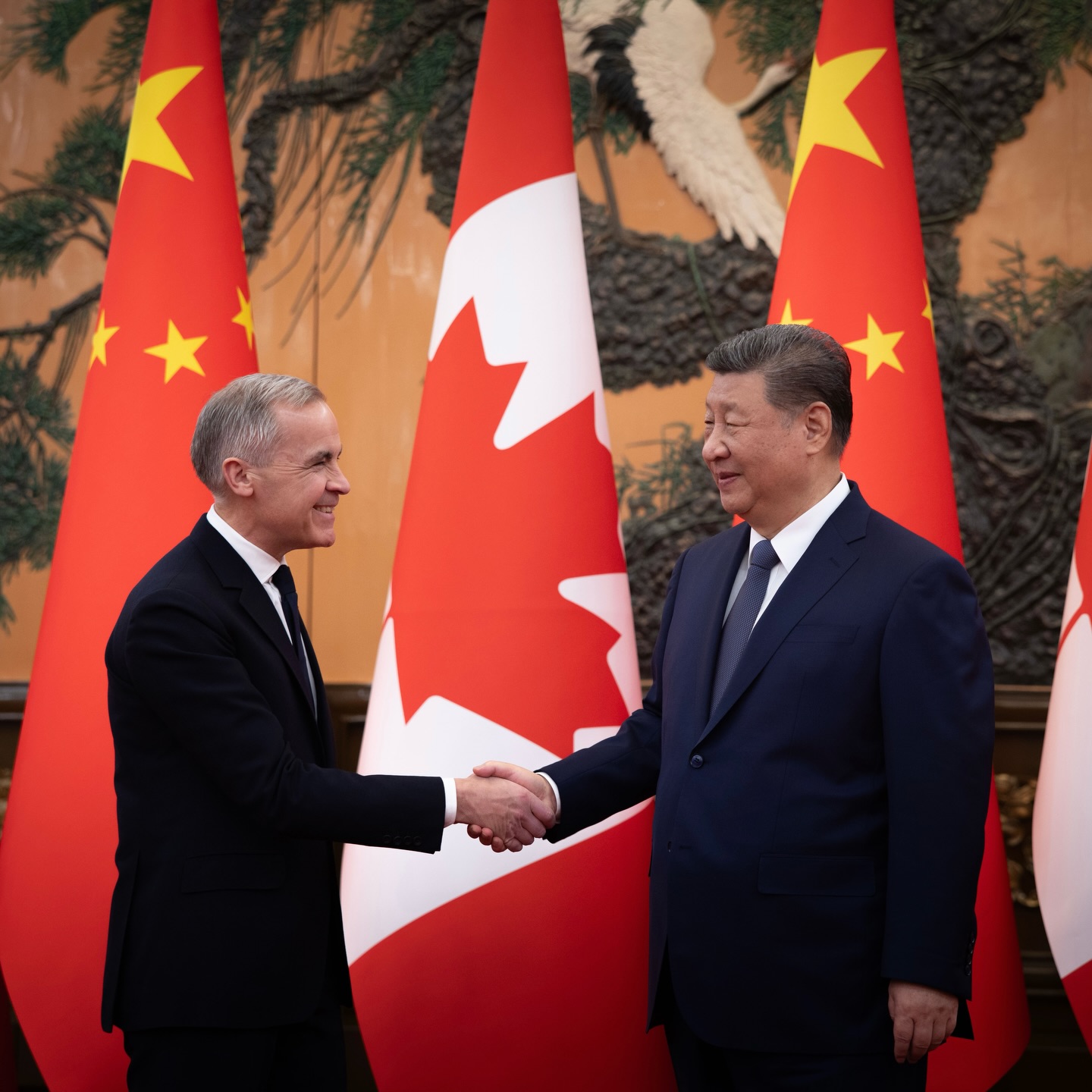

Picture source: National Development Council, October 26, 2021, National Development Council, https://www.ndc.gov.tw/nc_27_35335.

Prospects & Perspectives 2022 No. 31

CEE Relations with China and Taiwan in Times of European Crisis

By Paweł Paszak

May 24, 2022

The Russian invasion of Ukraine has further complicated relations between China and the Central and Eastern Europe (CEE) counties, while simultaneously creating favorable conditions for further Taiwan-CEE alignment.

The Russian Federation remains the most serious threat and the source of instability in the CEE and is also considered to be China’s only strategic partner in multiple domains. This close relationship with Moscow is useful in undermining the U.S.-led international order but has become a burden in terms of advancing cooperation with the CEE. By signing a joint communiqué in Beijing on February 4, 2022, China has become a silent accomplice in the war waged by Russia on Ukraine. Contrary to the narrative of peaceful coexistence, Beijing failed to prove that it is willing to stop Russia’s revisionist policy. On the contrary, it has provided Moscow with invaluable international support in its international isolation since 2014, when Russia annexed Crimea. For CEE countries, most of which have experienced Soviet occupation and communist rule during the Cold War, security comes first and China’s support for Russia has undermined its credibility as a partner.

The U.S.-led NATO, on the other hand, has demonstrated that it is the most credible alliance and deterrent against Russian neo-imperialism. Given the sometimes ambiguous stance of countries like Germany and France, the U.S. is regarded by CEE countries — particularly the Eastern Flank (Estonia, Latvia, Lithuania, Poland and Romania) — as the only partner capable and willing to balance against the threats arising from Russia’s actions. Due to its position as the leading provider of security in the region, the U.S. exercises profound influence on the political decisions of its Central European allies with regards to their cooperation with China, which Washington regards as a revisionist power and strategic competitor. This U.S. influence was particularly salient during the wide-ranging debate on the involvement of Huawei in the region’s 5G networks and the Comprehensive Agreement on Investment between the EU and China.

These factors have profoundly limited Beijing’s ability (with the exception of Hungary) to elevate political relations with the CEE beyond the existing moderate level. The 16+1 format established in 2012 to advance Beijing’s policy goals in the region has not met the expectations of both sides and may in fact have been considered a failure as the pact marked its 10th anniversary on April 24. The lack of tangible results in the form of rapid FDI inflow or export opportunities for the regional economies during the past decade has led to growing disillusionment with the virtues of bilateral cooperation with China.

New momentum in Taiwan-CEE political relations

Unlike China, Taiwan has proved to be a resilient democracy and a reliable partner for the U.S. and the EU in creating a united front against Russian aggression. Moreover, during the Covid 19 pandemic, Taiwan’s soft power potential increased significantly due to its effective containment of the virus as well as the support it gave to European countries — including the CEE — through the provision of medical supplies.

The current environment is facilitating greater engagement by both sides, as exemplified by the rising number of diplomatic and economic exchanges. Earlier this year, Polish Deputy Minister of Economic Development and Technology, Grzegorz Piechowiak, arrived in Taiwan on a three-day visit. The delegation arrived via a Polish government-chartered aircraft belonging to the Polish Air Force to enhance economic dialogue between Poland and Taiwan, as well as pave the way for more business cooperation and new investments.

The deputy minister’s visit was in line with earlier activities by the Czech, Lithuanian and Slovak governments. In October 2021, a delegation led by National Development Council Minister Kung Ming-hsin visited Czechia, Lithuania and Slovakia. During their visit, they signed 18 memorandums of understanding related to cooperation in sectors including science parks, electric vehicles, smart cities and tourism. On December 5, 2021, a Slovak delegation led by Deputy Economic Minister Karol Gale arrived in Taipei with a similar goal: to advance economic cooperation. However, it was Lithuania's decision to allow Taiwan to open a representative office in Vilnius in December 2021 and to withdraw from the 17+1 that highlighted growing skepticism toward China and greater openness toward Taiwan.

These developments signal a potential for Taiwan to make significant inroads in a region that had long been dominated by China.

Potential for investment cooperation between Taiwan and the CEE

Given the specific status of Taiwan in international politics and the growing relative power of China in the global balance of power, the options for Taiwan-CEE engagement remain understandably limited. Nevertheless, the high-tech sector seems to be a natural and safe choice for both sides.

The EU remains the largest source of FDI in Taiwan, amounting to 48 billion euros in 2019, representing 31% of all FDI inflows. Until 2020, Czechia, Hungary and Poland had accumulated more than US$2.6 billion in FDI from Taiwan, with Hungary claiming the top spot, followed by Czechia and Poland.

Taiwan’s semiconductor industry, with its national champion, TSMC, the largest fab manufacturer in the world, offers a plethora of options for a deepening economic partnership. Chip shortages in the European automotive industry resulting from pandemic disruptions have markedly reduced availability and increased the costs of production for countries in CEE. The CEE region, particularly the V4 and Romania, is deeply integrated with the global automotive value chains and plays a key role in the European market. The contribution of the sector to the national economies varies among the Visegrád Four, or V4, countries — Czech Republic, Hungary, Poland and Slovakia — but remains significant (Czech Republic 9%, Hungary 6%, Poland 2,3%, and Slovakia 13%). Diversification and nearshoring of chip supply would therefore be highly beneficial for the region and the broader EU chip development strategy, helping it to increase its share in global manufacturing from 9% to 20% by 2030.

Following the establishment of the Taiwan Trade Office in Vilnius, the Lithuanian government also signaled its willingness to advance cooperation in the semiconductor and high-tech sector. After the introduction of retaliatory sanctions by China in December 2021, Taiwan announced a US$200 million investment plan that increases the potential for deepening cooperation on chip production, especially in the area of talent sourcing and talent development.

Toward a new chapter in Taiwan-CEE relations

In the past, Taiwanese businesses tended to base their investment decisions on pragmatic assessments, with the pro-Beijing Hungary as the main recipient of FDI. As the V4 countries and other CEE states compete for potential investment with leading EU economies, they will likely try to leverage their economic influence to attract capital and highly-valuable industry assets. The degree do which warming political relations, MOUs and declarations will translate into tangible economic benefits for Taiwan and the CEE still remains to be seen. Nevertheless, with growing skepticism of China after Russia’s aggression in Ukraine, the failure of the 16+1 and the positive momentum at the EU, regional and global level, Taiwan has a unique window of opportunity to advance long-term relations with the V4 and the broader CEE region.

(Paweł Paszak is Member, Indo-Pacific program, Institute of New Europe)