Taiwan Can Help: Why CPTPP Members Should Recruit Taiwan as Soon as Possible

As the world moves toward 5G and the internet of things, it is in the best interest of existing CPTPP economies to guarantee access to Taiwanese suppliers at the lowest possible tariffs. Existing CPTPP members would thus be well-advised to recruit Taiwan as soon as possible, without giving in to external pressure to exclude it for someone else’s political agenda. Picture source: Unsplash, December 28, 2020, Unsplash,

Prospects & Perspectives 2022 No. 11

Taiwan Can Help: Why CPTPP Members Should Recruit Taiwan as Soon as Possible

By Scott Simon

February 25, 2022

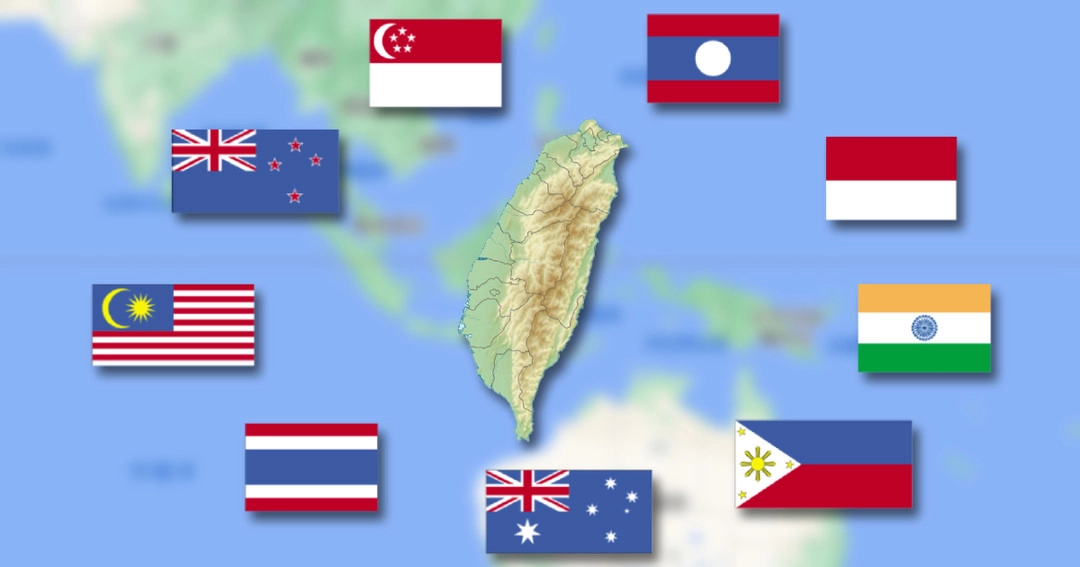

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) includes seven economies that ratified it from December 2018 to January 2019, and will eventually include four other original signatories. It is open to accession by other economies that meet its standards; and is currently in the process of evaluating potential members. A free-trade agreement, the CPTPP is intended to reinforce the rules-based international system and supply chain resilience, two pillars of the prosperity of the Pacific region that have been recently challenged by pandemic-related and geopolitical disruptions.

Taiwan submitted an application for membership in September 2021. In order to join the CPTPP, Taiwan needs to gain support of the seven members who have already ratified the agreement.

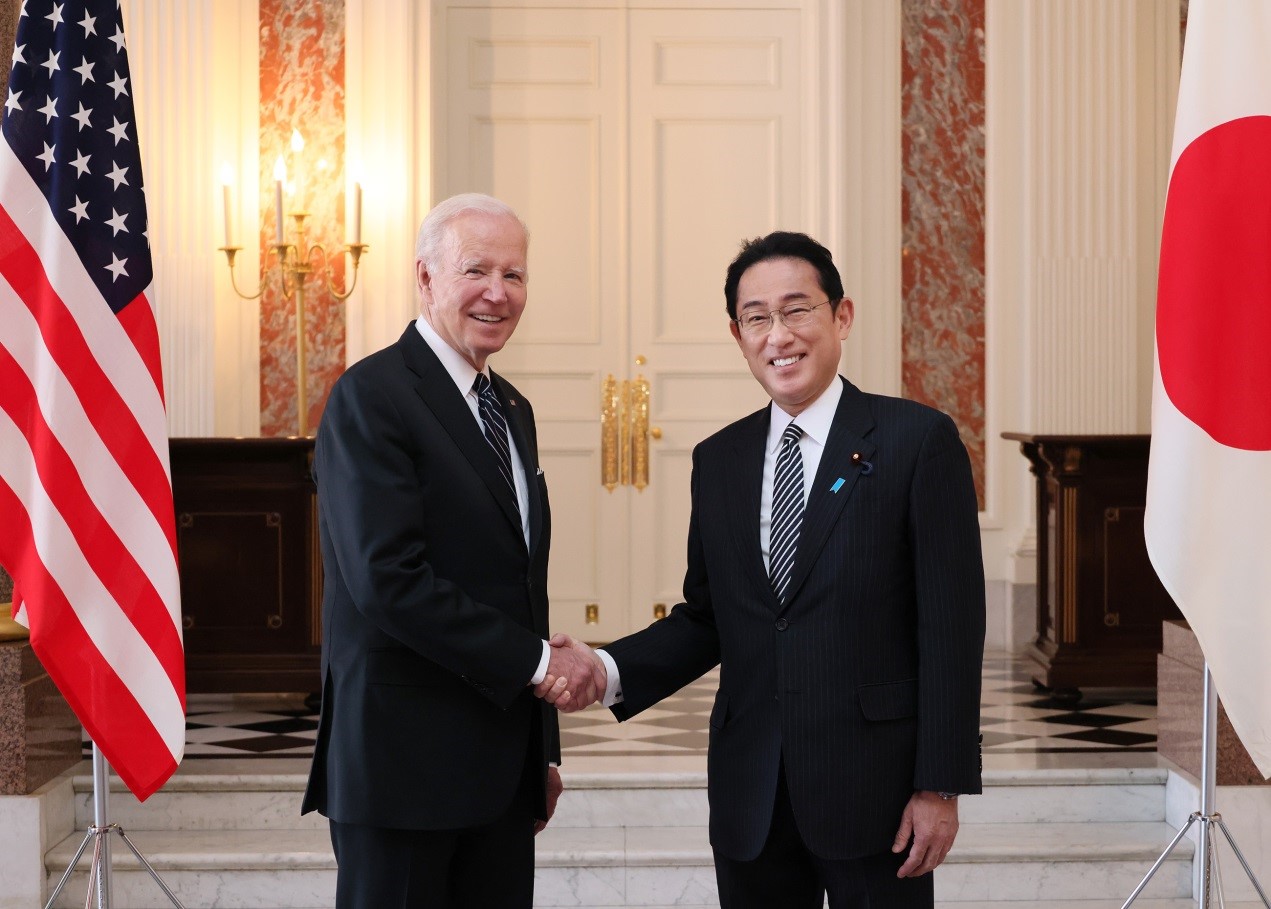

Among Taiwan’s existing free trade agreements (FTA) or economic cooperation agreements, two FTAs are with CPTPP members New Zealand and Singapore. Japan is Taiwan’s 3rd largest trading partner and Taiwan is Japan’s 4th largest. Taiwan and Japan coordinate trade through an annual Economic and Trade Conference, and have successively signed important agreements on specific areas. Taiwan has Bilateral Investment Agreements with Japan, Vietnam, and Malaysia. These existing relations have already integrated Taiwan with the CPTPP economies, which account for over 24% of Taiwan’s total international trade. So far, Japan and Australia have made the strongest public statements in support of Taiwan’s accession.

Taiwan has worked hard to meet CPTPP standards. Since the release of the CPTPP agreement, Taiwan has completed gap analysis to identify discrepancies between its current legal framework and CPTPP obligations. Since 2016, it has amended laws on fisheries, pharmaceuticals, and other areas to meet CPTPP standards, while also making key reforms in regard to such issues as insurance, taxation, and requirements for foreign professionals in Taiwan. On February 18 of this year, it lifted a ban on most food items from five Japanese prefectures affected by a 2011 nuclear plant meltdown and radiation exposure. This key step makes it easier for Japan to support Taiwan’s entry.

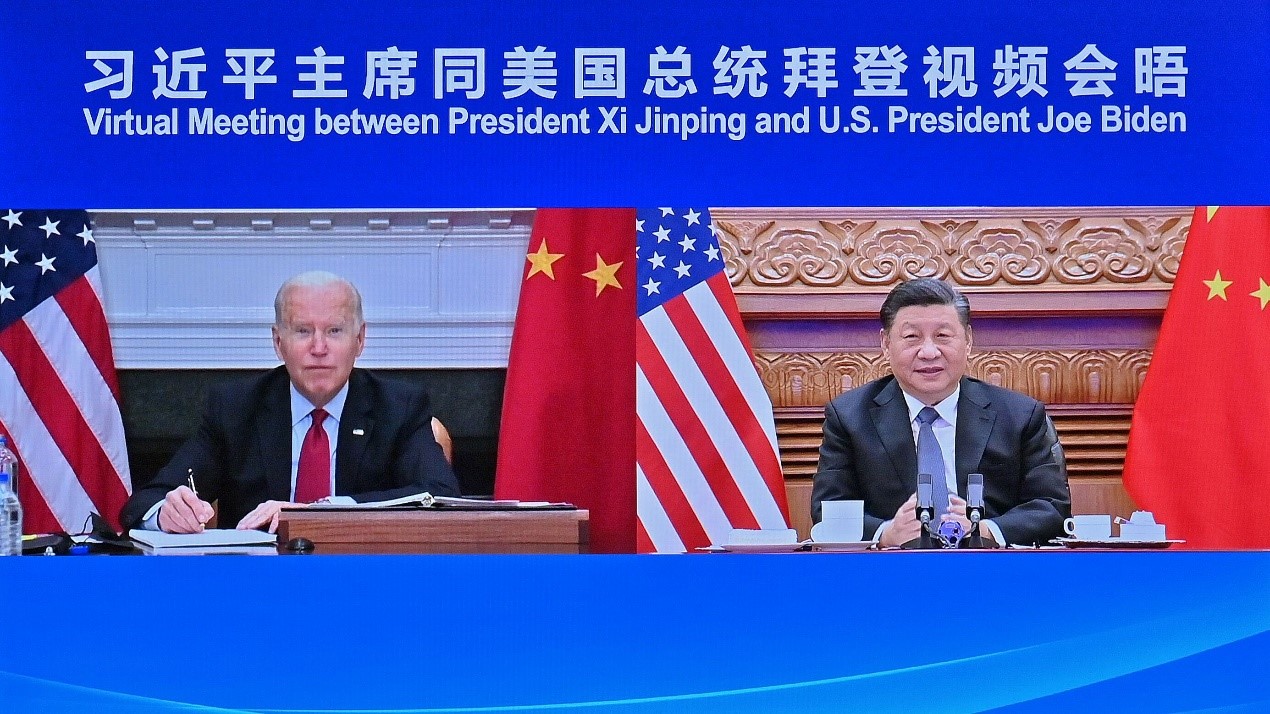

The main concern for all existing members is that China has also applied for membership and has opposed Taiwan’s entry as part of its strategy to isolate the country. China has transformed what should be a pragmatic question of trade into a geopolitical quandary. CPTPP members have the challenge of uniting economies to secure their own supply chains, necessary in the face of geopolitical risks, while managing relations with a rather mercurial China that tends to manipulate trade to advance political interests.

Canadian support for Taiwan’s entry is already strong. In 2019, Global Affairs Canada (GAC) conducted public consultations about possible new members. Among the 12 markets specifically identified by GAC, Taiwan received the 2nd highest level of support, second only to Thailand. South Korea and the United Kingdom also were highly regarded. Businesses saw potential for new opportunities for Canadian producers of agricultural products, chemicals and plastics, cleantech, engineering, and financial services. The objective is not to create an entirely new market, but rather to deepen further Taiwan’s trade relations with existing members by lowering tariffs, harmonizing standards, and expanding mutual opportunities for government procurements of goods and services.

Canada has solid reasons to support Taiwan’s membership. Taiwan in 2020 was Canada’s 15th largest trading partner in the world, and 6th in Asia. In the other direction, Canada was Taiwan’s 23rd largest trading partner. Canada supplies Taiwan with natural resources and agricultural products; whereas Taiwan sells Canada industrial products. The two economies are usually complementary, as when Taiwan sells Canada automotive parts and semiconductor chips needed in cars, while purchasing cars and other vehicles assembled in Canada.

Mexico could be vulnerable to Chinese pressure, considering that their diplomatic protocol recognizes that Taiwan is an “unalienable part of Chinese territory,” albeit while explicitly calling for the development of “private economic and cultural ties with Taiwan.” But, ever since Taiwan and Mexico mutually opened up economic and cultural offices in the early 1990s, Taiwan has become Mexico’s third largest investor from Asia and its 9th largest trading partner. The goal should be to foreground pragmatic concerns of trade and investment. To placate political concerns, Taiwan has applied to join the CPTPP as the “Separate Customs Territory of Taiwan, Penghu, Kinmen, and Matsu,” the same title it uses at the World Trade Organization (WTO). Canada and other partners need to convince Mexico that the CPTPP is an elite sub-set of WTO members with high standards, not a new geopolitical strategy to contain China.

In Southeast Asia, Taiwan can emphasize their existing close links. Despite the Covid pandemic, for example, Taiwanese investment in Vietnam increased 53% in 2020. In 2021, Taiwan was Vietnam’s sixth largest investor, mostly in electronics. Taiwan is thus helping Vietnam improve its ranking in global manufacturing value chains. Due to large numbers of Vietnamese people moving to Taiwan for work or marriage, the two societies are growing closer. Taiwan’s accession to the CPTPP can accelerate this ongoing socio-economic integration.

The expansion of the CPTPP is most likely to succeed if existing members maintain that the goal is not to exclude or contain any state. All other economies, including China, are welcome as long as they meet the agreement’s standards and restrain from weaponing trade. In fact, since the goal is to promote high trade and manufacturing norms, the ideal outcome would be for China to meet accession criteria and join the club. That is an issue for the future.

Right now, Taiwan meets most CPTPP requirements and it provides important products to secure the supply needs of member economies. Taiwan is the world’s largest supplier of semiconductor chips needed for electronics and automobile manufacturing. As the world moves toward 5G and the internet of things, it is in the best interest of existing CPTPP economies to guarantee access to Taiwanese suppliers at the lowest possible tariffs; and also, to attract inbound Taiwanese investment. Existing CPTPP members would thus be well-advised to recruit Taiwan as soon as possible, without giving in to external pressure to exclude it for someone else’s political agenda.

(Scott Simon is Professor, Sociological and Anthropological Studies, Faculty of Social Sciences, University of Ottawa.)