U.S. Trade Policy and Reciprocal Tariffs: Challenges and Opportunities

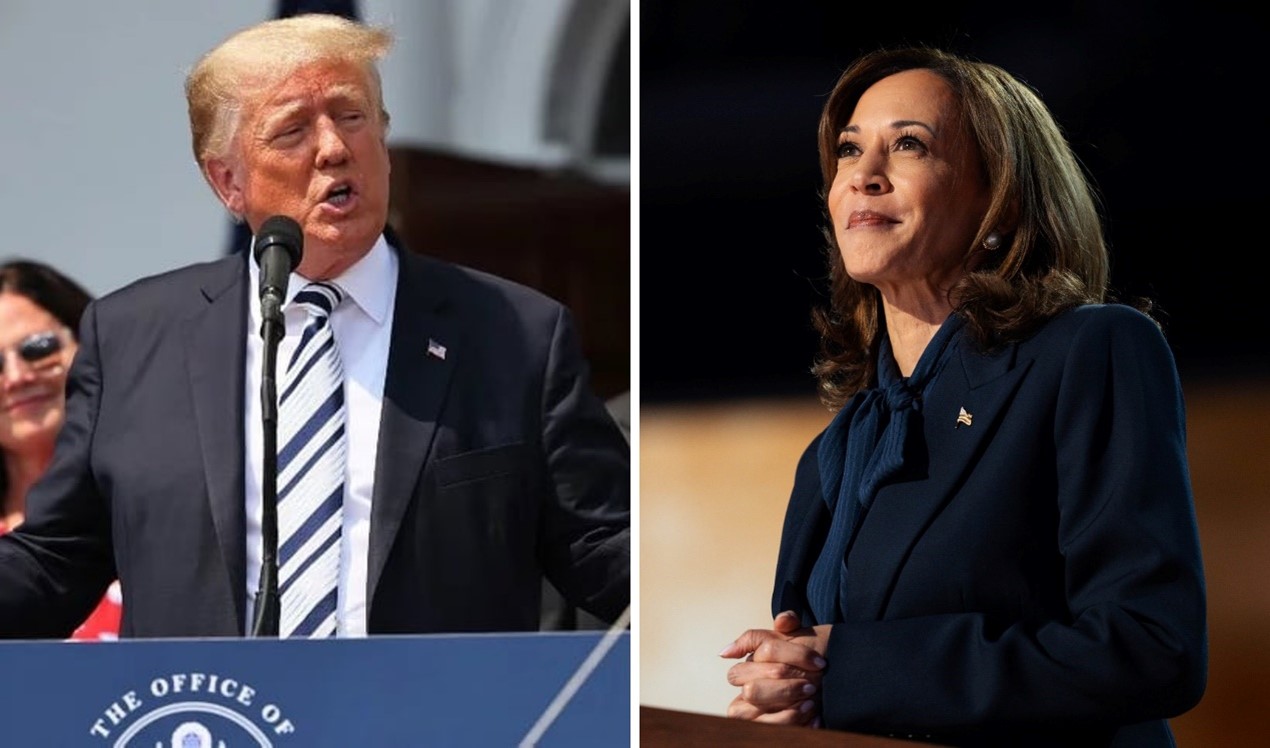

Since assuming office, President Donald Trump has pursued a series of aggressive trade policies, with tariffs serving as a direct and effective instrument for achieving his administration’s economic objectives. Picture source: Depositphotos.

Prospects & Perspectives No. 13

U.S. Trade Policy and Reciprocal Tariffs: Challenges and Opportunities

By Hsien-Ming Lien

Since assuming office, President Donald Trump has pursued a series of aggressive trade policies, with tariffs serving as a direct and effective instrument for achieving his administration’s economic objectives. The initial imposition of tariffs was justified under international economic security laws, targeting key trading partners such as Canada, Mexico, and China. Subsequent measures were expanded to industries deemed critical to U.S. national interests, including steel, aluminum, semiconductors, and medical supplies. Most recently, the administration has introduced the concept of reciprocal tariffs, proposing tariff adjustments based on trade imbalances with various countries. These sweeping and often unilateral tariff measures have not only disrupted traditional U.S. trade relationships but have also placed immense pressure on global manufacturing networks and supply chains, forcing a reconfiguration of international trade flows.

Corrective mechanism

Trump’s approach to tariffs is rooted in both economic theory and strategic policy implementation. On a theoretical level, Trump and his advisors argue that the U.S. dollar’s role as the world’s reserve currency has led to the inability of the U.S. dollar to flexibly adjust its value, negatively impacting American manufacturing competitiveness while disproportionately benefiting foreign economies that operate within the stable financial framework provided by the U.S. From this perspective, tariffs serve as a corrective mechanism to address perceived distortions in global trade and to restore the competitiveness of domestic industries.

On a strategic level, Trump employs a “pressure first, negotiate later” approach, using tariffs as a bargaining tool to force trade partners into adjusting their economic structures. This approach effectively weaponizes tariffs to extract concessions and promote what the administration views as fairer trade practices. By combining external tariff hikes with domestic tax reductions, the Trump administration has aimed to pressure trade partners into lowering their own tariff barriers while simultaneously incentivizing investment in the U.S. and encouraging the reshoring of manufacturing industries.

Impact on Taiwan

Among the three major rounds of tariffs implemented during Trump’s tenure, two have been particularly relevant to Taiwan. The first pertains to tariffs imposed on the semiconductor industry. However, after Taiwan Semiconductor Manufacturing Company (TSMC) announced a US$100 billion investment in the U.S., some of the tariff pressure on Taiwan’s semiconductor sector has eased. The second, and potentially more impactful, concerns the administration’s push for reciprocal tariffs. The core principle of reciprocal tariffs is to target economies with significant trade surpluses with the U.S. and investigate whether these economies impose disproportionately high tariffs on American products. The goal is to reduce trade imbalances by compelling trade partners to adopt more equitable tariff structures. Consequently, discrepancies in tariff rates between Taiwan and the U.S. have emerged as a key point of contention.

According to data from the Bureau of International Trade, Taiwan’s average tariff rate is approximately 6.29%, or about 2.05 percentage points higher than that of the U.S. While this difference is not particularly large, it remains a factor in trade negotiations. A more detailed analysis using the Harmonized System (HS) six-digit classification reveals that approximately 75% of Taiwan’s exports to the U.S. consist of information and communication technology (ICT) products, which benefit from tariff exemptions. However, when excluding duty-free products and those with tariffs lower than U.S. rates, approximately 2,012 product categories exhibit a tariff gap of 0% to 10%, with the total value of 2024 imports reaching $15.773 billion. Additionally, 535 product categories have a tariff gap exceeding 10%, with imports totaling $1.57 billion. Among these, the automotive sector is particularly vulnerable, with “vehicles and parts” accounting for US$880 million in imports, making it one of the industries most affected by potential reciprocal tariff measures. Other key sectors that could face a significant impact include processed foods, seafood, grains, starches, and dairy products, all of which have import values in the hundreds of millions of dollars.

Despite the relatively moderate tariff gap, Taiwan must carefully consider three key factors when addressing reciprocal tariff policies. First, Taiwan’s trade surplus with the U.S. is substantial, reaching nearly US$75 billion in 2024, making it the sixth-largest contributor to the U.S. trade deficit globally. Consequently, Taiwan has been placed on the U.S. trade watchlist in reports by Trump’s trade advisor, Peter Navarro. It is ranked just below China and India, which are categorized as Tier One countries, and alongside the European Union, Thailand, and Vietnam in the Tier Two category. This designation subjects Taiwan to heightened scrutiny and increases the likelihood of facing additional trade policy measures from the U.S.

Second, reciprocal tariff policies extend beyond direct tariff rate comparisons and may include broader trade considerations such as value-added tax (VAT) policies and other perceived unfair trade practices. Taiwan has historically provided subsidies for electricity and water prices, workforce training programs, and certain strategic industries. While these policies have played a role in strengthening Taiwan’s industrial competitiveness, they may also be viewed by the U.S. as trade distortions, warranting close monitoring and careful policy adjustments to mitigate risks associated with U.S. trade enforcement measures.

Taiwan’s potential responses

In the context of heightened geopolitical tensions and rapidly evolving global trade dynamics, Taiwan must enhance its capacity to engage in sophisticated trade negotiations and international economic diplomacy. This necessitates the development of a strong pool of experts in international trade law, policy formulation, and dispute resolution. By fostering a more robust trade policy framework, Taiwan can adopt more flexible and effective strategies to navigate global trade disputes and safeguard its economic interests.

Ultimately, reciprocal tariff policies are not merely a tool for U.S. economic leverage but also serve as a strategic instrument in broader international trade negotiations. As the global economic landscape remains highly fluid and unpredictable, governments must proactively adjust their trade policies, balancing domestic economic stability with external competitive pressures. For Taiwan, ensuring continued access to the U.S. market while maintaining trade resilience will require a combination of diplomatic engagement, policy innovation, and a deep understanding of evolving trade frameworks. By taking a proactive stance, Taiwan can not only mitigate potential risks but also position itself more favorably within the global trade order.

(Dr. Lien is President of the Chung-Hua Institute of Economic Research; Distinguished Professor at the Department of Public Finance, National Chengchi University)