A Geopolitical Inflection Point: The Deeper Implications of the U.S.-Taiwan Reciprocal Tariff Agreement for Bilateral Relations

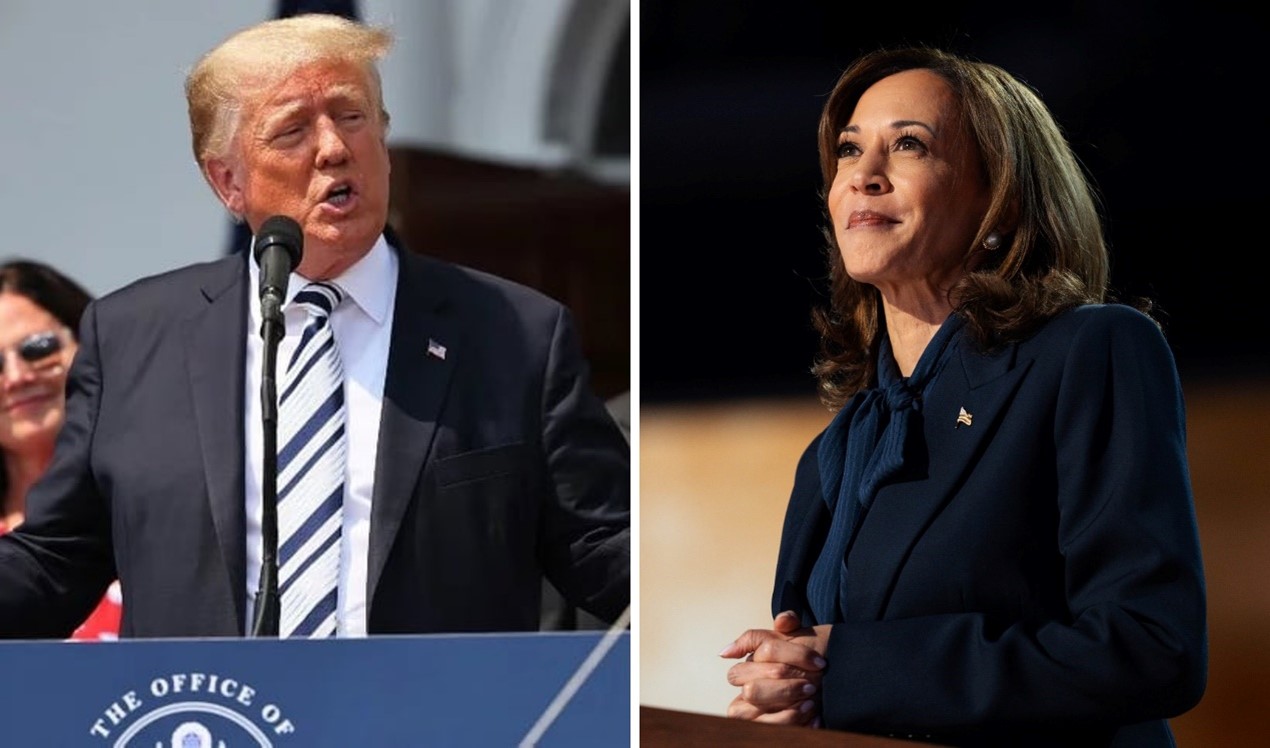

Over the past nine months, Taiwan moved from facing the threat of punitive tariffs as high as 32%, to a temporary rate of 20%, and ultimately to a reduced reciprocal tariff rate of 15% that is not stacked on top of the Most-Favored-Nation tariff. The process was marked by substantial uncertainty and difficult bargaining. Nonetheless, the outcome not only defused a looming bilateral trade crisis, but also established a new framework for U.S.-Taiwan economic relations. Picture source: 鄭麗君, January 19, 2026, Facebook, https://www.facebook.com/photo?fbid=1444274437060785&set=pcb.1444275607060668&locale=zh_TW.

Prospects & Perspectives No. 8

A Geopolitical Inflection Point: The Deeper Implications of the U.S.-Taiwan Reciprocal Tariff Agreement for Bilateral Relations

By Hsienming Lien

With representatives from the United States and Taiwan convening a formal concluding meeting in Washington, D.C., in January, a U.S.-Taiwan trade agreement negotiated over nearly a year has been brought to closure. Over the past nine months, Taiwan moved from facing the threat of punitive tariffs as high as 32%, to a temporary rate of 20%, and ultimately to a reduced reciprocal tariff rate of 15% that is not stacked on top of the Most-Favored-Nation (MFN) tariff. The process was marked by substantial uncertainty and difficult bargaining. Nonetheless, the outcome not only defused a looming bilateral trade crisis, but also established a new framework for U.S.-Taiwan economic relations.

A new framework

According to Taiwan’s Executive Yuan, the agreement rests on four pillars: (1) the reciprocal tariff is reduced to 15% and without MFN stacking; (2) semiconductors and semiconductor-derived products obtain most-favored treatment under Section 232; (3) supply-chain investment cooperation is expanded; and (4) the U.S.–Taiwan strategic partnership in artificial intelligence (AI) is further deepened. These provisions indicate that tariff relief is being operationalized as part of a broader bargain over production geography, technology governance, and supply-chain security. In other words, the agreement functions as a strategic economic compact rather than a conventional market-access deal. Its implications can be clarified through three interlocking dimensions.

First, for traditional industries, the reciprocal tariff is set at 15% and is not stacked. This rate is aligned with those applied to major export competitors such as Japan, South Korea, and the European Union. For Taiwan’s traditional manufacturing sectors—such as machine tools and hand tools—this alignment is consequential: for the first time in more than a decade, these industries can compete in the U.S. market on broadly comparable tariff terms with their principal rivals.

Second, Taiwan agreed to pursue two investment arrangements in exchange for most-favored treatment under Section 232. Because as much as three-quarters of Taiwan’s exports to the United States consist of information and communications technology (ICT) products, exposure to Section 232 tariffs is extremely crucial for Taiwan. Under the first arrangement, Taiwanese firms will invest US$250 billion in areas including semiconductors, AI applications, electronics manufacturing services (EMS), and energy. Under the second arrangement, the Taiwanese government will provide support—via credit guarantees and related instruments—of up to an additional US$250 billion to assist firms, especially small and medium-sized enterprises, in investing in the United States. Collectively, these arrangements are intended to reduce tariffs imposed under Section 232 and, potentially, to secure exemptions, particularly for semiconductors. The agreement further provides that raw materials, equipment, and components necessary for Taiwanese firms’ U.S.-based operations may be exempted from relevant tariffs, thereby lowering frictional costs associated with cross-border production relocation and plant operations.

Third, the agreement establishes a two-way investment mechanism for the first time. This mechanism is designed to encourage U.S. investment in Taiwan’s “five trusted industries” (e.g., semiconductors, AI, and defense-related sectors). By linking U.S. provision of critical technologies with Taiwan’s advanced manufacturing capacity, the mechanism aims to expand Taiwan’s access to strategic industries central to the United States’ future industrial and technological agenda.

‘Quasi-MFN’ status

Taken as a whole, the agreement can be interpreted as a deepening of U.S.-Taiwan cooperation through institutionalized arrangements. From the tariff treatment for traditional industries, Taiwan is positioned similarly to other allied partners, effectively obtaining a de facto “quasi-MFN” status in U.S. trade. This minimum tariff rate signals that, within the broader process of supply-chain reconfiguration, the U.S. is positioning Taiwan as a long-term partner—and that Taiwan is expected to leverage its comparative advantage in manufacturing and supply-chain management to support U.S. re-industrialization.

Regarding the Section 232 most favored nation treatment for the technology sector, although this arrangement has been criticized for appearing to “purchase” tariff relief through large-scale investment, it becomes more evident for Taiwanese semiconductor firms, in light of explosive AI demand, to increase proximity to end markets and key customers. Therefore, large-scale investment in the United States becomes not only a bargaining instrument but also a business necessity. Under these conditions, investment can generate strategic returns by enabling deeper integration with major U.S. technology firms, thereby positioning Taiwanese suppliers as indispensable partners within the U.S. AI ecosystem. This is especially important because, under intensifying U.S.-China technology competition, Taiwan has limited room to simultaneously participate in China’s semiconductor and AI supply chains. By contrast, Taiwan’s global market shares in AI chips and AI servers both exceed 90%, creating structural complementarities with U.S. leadership in AI and advanced semiconductors.

Establishing a ‘Taiwan model’

In addition, the agreement adopts a “Taiwan model” for private-sector investment by exporting Taiwan’s science-park governance experience as an institutional template and forming industrial clusters through public–private collaboration. This approach allows Taiwanese firms to compete in the U.S. market by mobilizing strengths in supply-chain coordination and ecosystem management, while reducing the institutional costs that would arise if firms were forced to operate in a fragmented, firm-by-firm manner.

Finally, for startups and emerging industries, the United States has historically prioritized cooperation with allied partners and often kept cutting-edge technologies within traditional allies, such as Europe, Israel, or Japan. In this agreement, however, the United States and Taiwan commit to combining U.S. startup technologies with Taiwan’s advanced manufacturing capacity, converting geopolitical pressures surrounding strategic industries into a more organized pathway for industrial collaboration. For Taiwanese startups in relevant fields, this provides a clearer and more actionable framework for cooperation with the United States.

In sum, the agreement seeks not only to manage trade frictions, but also to institutionalize a technology-and-investment interface that strengthens a broader framework for industrial cooperation—one aimed to reconcile supply-chain security with high-technology competition. If the agreement is approved by Taiwan’s Legislative Yuan, the bilateral relationship may shift from one centered on contract manufacturing toward a partnership in AI and innovation-driven sectors. Beyond the existing division of labor, U.S.-Taiwan ties could evolve into deeper collaboration around AI and startup ecosystems. Taiwan would thus become not merely a production node in U.S. re-industrialization, but an indispensable partner for the U.S. high-technology competitive strategy and the construction of supply-chain resilience.

(Hsienming Lien is President of the Chung-Hua Institute of Economic Research, Associate Director of the Institute of DSET, and Distinguished Professor in the Department of Public Finance at National Chengchi University.)