Assessing China’s Economic Outlook through the Two Sessions Policy and Trump’s Tariff Strategy

In response to Trump’s tariff offensive, the Chinese government has implemented extraordinary fiscal measures to accelerate technological self-sufficiency and stimulate domestic consumption. China has been proactively preparing for such scenarios since 2018. Its swift and forceful countermeasures underscore a growing sense of confidence within the Chinese Communist Party. However, the current pace of deterioration in U.S.-China economic relations may have exceeded Beijing’s expectations. Picture source: Depossitphotos.

Prospects & Perspectives No. 21

Assessing China’s Economic Outlook through the Two Sessions Policy and Trump’s Tariff Strategy

By Guo-Chen Wang

The third sessions of the 14th National Committee of the Chinese People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC), commonly known as the “Two Sessions,” were held on March 5, 2025. This year coincides with the conclusion of both the Made in China 2025 initiative and the 14th Five-Year Plan for National Economic and Social Development. Meanwhile, the return of U.S. President Donald Trump and the re-intensification of the tariff conflict have brought increased attention to China’s policy responses.

This article analyzes China’s economic prospects through the lens of its Government Work Report and the renewed U.S. tariff measures. The analysis first examines China’s economic policy objectives, key areas of implementation, and fiscal planning. It then traces the trajectory of U.S. tariff impositions on China and quantifies their economic impact. This is followed by an assessment of the effectiveness of China’s macroeconomic regulation and identifies potential policy risks. The final section presents conclusions and future outlooks.

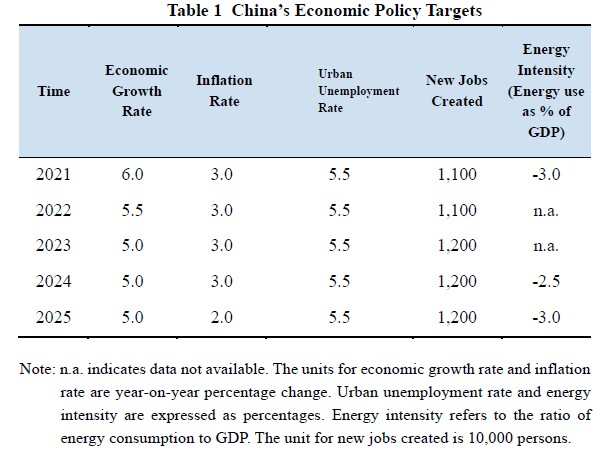

Deployment of Economic Policies

China aims to ascend to the middle tier of developed economies by 2035. Based on this projection, the average annual GDP growth rate during the 14th Five-Year Plan period (2021–2025) must reach approximately 5.0%; this growth target has been reaffirmed for the current year. Meanwhile, energy intensity — defined as energy consumption per unit of gross domestic product (GDP) — is set to decline by an additional 0.5 percentage points compared to the previous year, reflecting efforts to ensure that carbon dioxide emissions peak by 2030.

The surveyed urban unemployment rate is targeted to remain within 5.5%, a level that has been consistently maintained for five consecutive years. The goal for new urban employment is set at 12 million, unchanged for the third consecutive year. However, the target for the annual growth rate of the Consumer Price Index (CPI) has been lowered by 1.0 percentage point to 2.0% — marking the first adjustment of this kind during the 14th Five-Year Plan period. This shift signals a policy transition in Beijing’s economic governance, from combating inflation to addressing deflationary pressures. (Table 1)

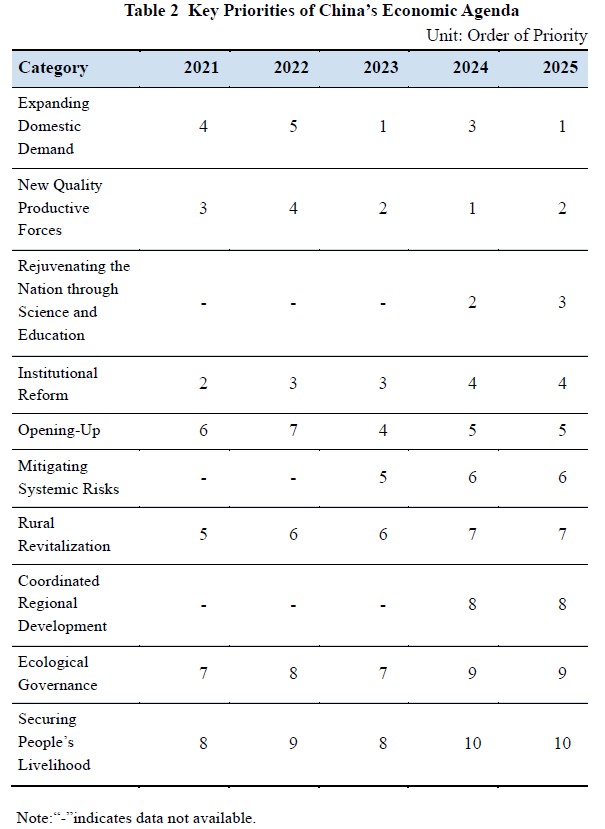

Revitalizing domestic consumption is considered central to addressing deflationary pressures. As shown in Table 2, the top priority of this year’s economic agenda is the expansion of domestic demand. In comparison, the development of new quality productive forces and the strategy of revitalizing the nation through science and education have been slightly downgraded in rank. The remaining seven priorities remain unchanged from the previous year, and include institutional reform, further opening to the outside world, mitigation of systemic risks, rural revitalization, new-type urbanization and coordinated regional development, carbon reduction and green transformation, as well as ensuring public welfare and improving social governance.

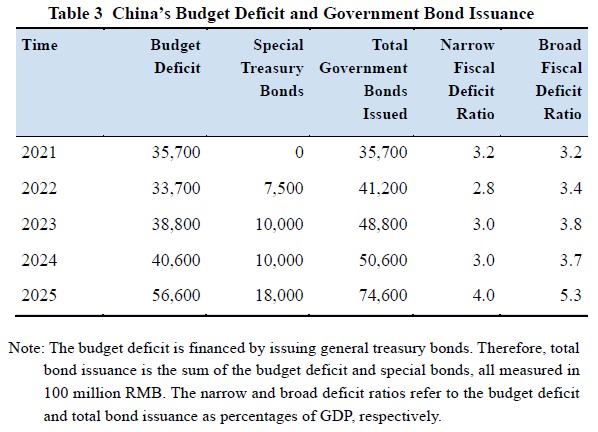

Accordingly, this year’s fiscal deficit has reached RMB 5.66 trillion, marking a 39.4% increase from the previous year. The deficit-to-GDP ratio has surged to 4.0%, exceeding the European Union’s 3.0% threshold. In addition, China has issued RMB 1.8 trillion in special treasury bonds to support key strategic and security-related projects, facilitate equipment upgrades and trade-in programs for consumer goods, and reinforce the core Tier 1 capital of major state-owned banks. Taking these special bonds into account, the broad fiscal deficit ratio rises to 5.3%. (Table 3)

Impact of U.S. Tariffs

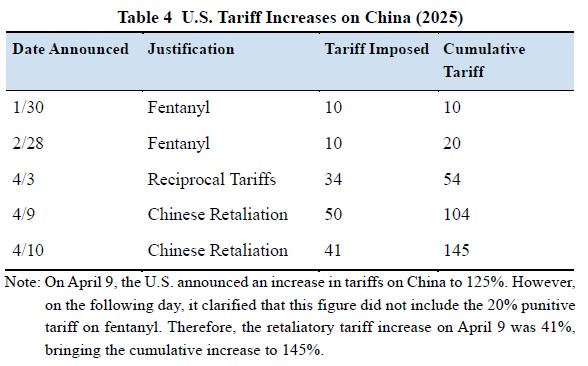

President Trump’s aggressive tariff policy has further fractured the already fragile economic and trade relations between the United States and China. As of April 12, 2025, Washington has launched five rounds of tariff sanctions against China. The justifications include punitive measures targeting fentanyl (20%), reciprocal tariffs (34%), and retaliatory countermeasures (91%). Consequently, the effective U.S. tariff rate on Chinese imports has surged to 145%. Including the residual tariffs from Trump’s first term (19%), the cumulative rate could reach as high as 164%. (Table 4)

The tariff escalation has also extended to specific product categories. In December 2024, then-President Joe Biden doubled tariffs on Chinese solar wafers and polysilicon to 50%, and raised duties on certain tungsten products to 25%. In February 2025, Donald Trump announced a 25% global tariff on steel and aluminum. By April, the tariff on Chinese small-value parcels under US$800 was quadrupled to 120%, while duty exemptions for synthetic opioids were revoked.

Trump further introduced secondary tariff sanctions. In March, the United States imposed a 25% tariff on any country importing Venezuelan oil and gas, with China being the most affected. Washington also demanded that other countries sever industrial ties with China. In response, Mexico considered imposing equivalent tariffs to gain exemptions from U.S. duties. Vietnam intensified inspections on sensitive imports from China, while Japan imposed a 95.2% anti-dumping tariff on Chinese graphite electrodes.

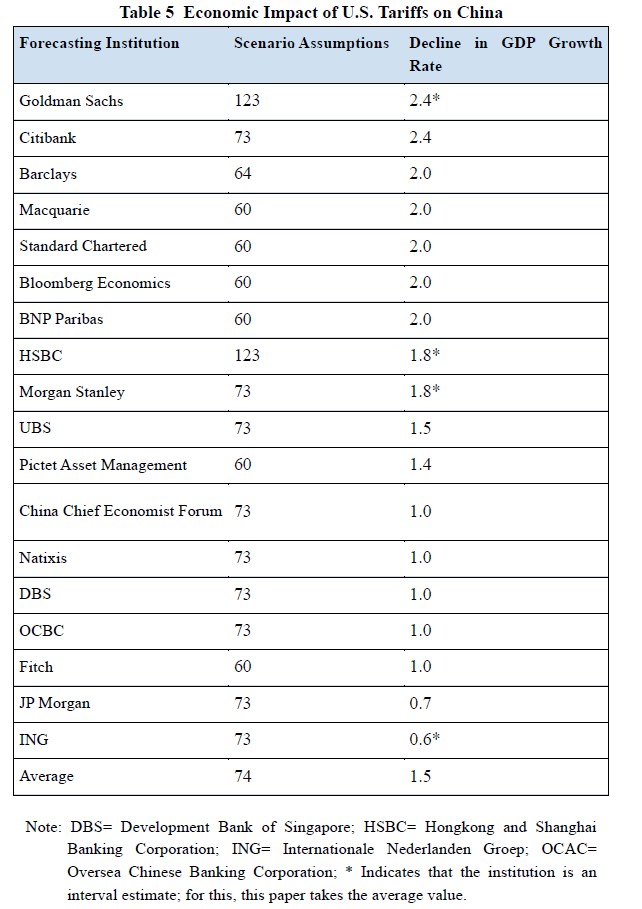

Table 5 summarizes the tariff impact estimates from 18 investment banks. Assuming Trump were to impose a 74% tariff on Chinese imports, China’s GDP growth would decline by 1.5%. However, with current rates having doubled to 164%, Bank J. Safra Sarasin and The Wall Street Journal have both declared that U.S.-China trade has entered a state of full decoupling. In response, Fitch Ratings downgraded China’s sovereign credit rating to A.

Limited Policy Effectiveness

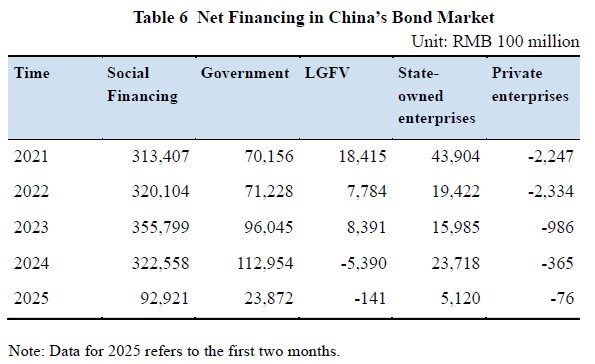

China plans to counter the impact of U.S. tariffs through fiscal expansion. However, as shown in Table 6, net government financing reached RMB 11.2954 trillion in 2024. Combined with net repayments of RMB 539 billion by local government financing vehicles (LGFVs), public sector financing accounted for 33.3% of total social financing — an increase of 5.1 percentage points compared to 2021. During the same period, the share of financing by state-owned enterprises (SOEs) declined by 6.7 percentage points, while private enterprises recorded a cumulative net repayment of RMB 600.8 billion. These figures indicate that government borrowing has significantly crowded out corporate access to financing.

Persistent difficulties in the corporate sector have led to prolonged economic stagnation. The Consumer Confidence Index (CCI) has remained below the neutral threshold of 100 for 35 consecutive months, with an average reading of only 87.8, placing it firmly within the zone of severe contraction. The year-on-year growth rate of the CPI has stayed below 1% for 23 consecutive months, while the Producer Price Index (PPI) has contracted for 27 straight months. Since the PPI typically leads the CPI by approximately six months, these trends suggest that China remains mired in deflationary pressures.

Moreover, China has fallen into a balance sheet recession (BSR). The five-year personal housing provident fund loan rate was cut from 4.11% in June 2023 to 3.00% by the end of 2024. Nevertheless, the outstanding balance of individual mortgage loans has contracted for seven consecutive quarters. As a result, the prices of newly constructed homes in 70 major and mid-sized cities have declined for 35 consecutive months. This phenomenon, also known as “secondary deflation,” underscores the diminishing effectiveness of macroeconomic policy interventions. (Figure 1)

The limited effectiveness of policy measures relative to their costs has led to a rapid expansion of government debt. As of the end of February 2025, the People’s Bank of China (PBoC) held RMB 21.7 trillion in claims on the government and financial institutions, accounting for 46.1% of its total assets — a 13.7 percentage point increase compared to the end of 2017. The correlation coefficient between these claims and the PBoC’s total assets reached 95.4%, contributing to a 1.3-fold expansion in the central bank’s balance sheet to RMB 47.0 trillion. This reflects a serious degree of monetary overexpansion and a rapid erosion of the foreign exchange credit base.

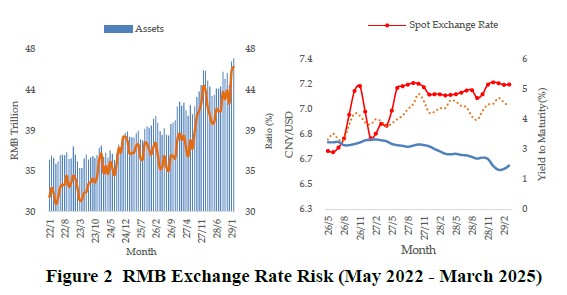

China has also suppressed government bond yields to reduce interest payment burdens. The issuance yield on 10-year government bonds fell from 2.76% in May 2022 to 1.61% in March 2025, guiding the benchmark yield downward by 0.97 percentage points. Consequently, the yield spread between U.S. and Chinese 10-year bonds widened to 2.35 percentage points. In tandem, the RMB/USD spot exchange rate depreciated from 6.707 to 7.174, amounting to a 7.0% decline. As a result, exchange rate risks have continued to rise. (Figure 2)

Conclusion

In response to Trump’s tariff offensive, the Chinese government has implemented extraordinary fiscal measures to accelerate technological self-sufficiency and stimulate domestic consumption. China has been proactively preparing for such scenarios since 2018. Its swift and forceful countermeasures underscore a growing sense of confidence within the Chinese Communist Party. However, the current pace of deterioration in U.S.-China economic relations may have exceeded Beijing’s expectations. In particular, the government’s aggressive borrowing strategy has jeopardized the viability of private enterprises and traditional industries. In sum, China’s policy response appears to have taken a misguided turn — reverting to a quasi-planned economy — which may ultimately result in a prolonged economic downturn.

(Dr. Wang is Assistant Research Fellow, First Research Division, Chung-Hua Institution for Economic Research (CIER).)