Taiwanese Companies Are Restructuring Their China-Centered Production Model and Look to Benefit from a Transition to a New Supply Chain

In addition to investing in Taiwan, Taiwanese firms have put greater emphasis on investing in Southeast and South Asian countries, such as Vietnam and India. This is because developing countries have been trying to establish a new supply chain to help reduce economic dependence on China.

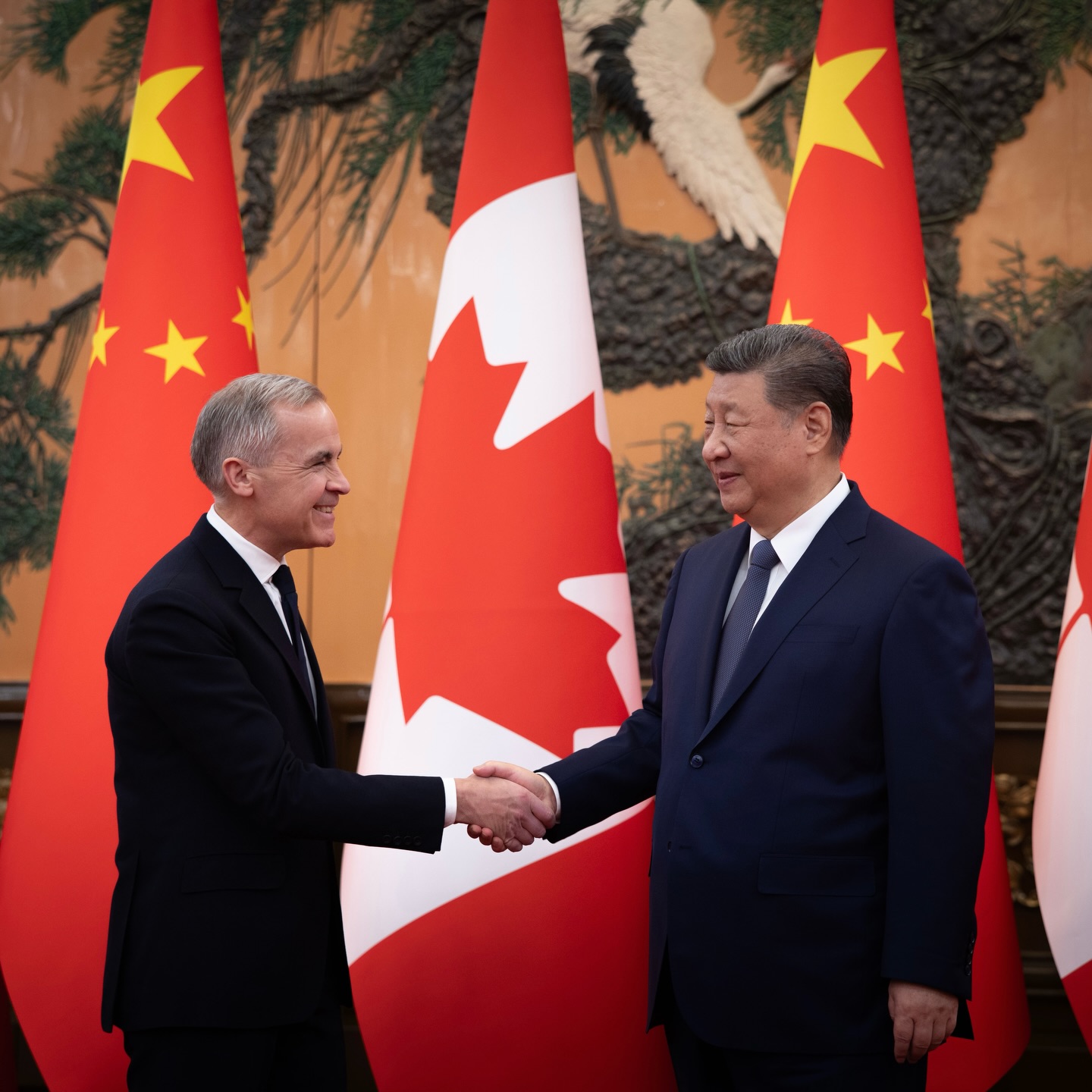

Picture source: MOEA, December 18, 2019, MOEA, https://www.moea.gov.tw/MNS/populace/news/News.aspx?kind=1&menu_id=40&news_id=88224.

Prospects & Perspectives 2022 No. 8

Taiwanese Companies Are Restructuring Their China-Centered Production Model and Look to Benefit from a Transition to a New Supply Chain

By Ming-fang Tsai

February 15, 2022

Before 2018, the main strategy of most multinational firms focused on cost-reducing investment and market expansion. Under this model, China was a most attractive country in terms of Foreign Direct Investment (FDI) because it was the country with the largest population in the world and provided a demographic dividend. Under the trend of globalization, both the lower transportation costs and the elimination of trade barriers further enhanced this population advantage for China. As a result, the Chinese economy continued to grow and became the world’s factory. As the growing labor demand increased population employment and per capita income in China, the growing Chinese retail market became another attractive point and the revenues of many international brand firms became increasingly dependent on the Chinese market. However, when the revenue of a firm or the economy of a country depends on a single country, such as China, the authorities of this single country can resort to economic coercion to force trade partners (e.g., Taiwan, Australia, and Lithuania) or firms. How to reduce economic dependence on China has always been a tough issue for the global economy, but thus far such a strategy appears to have resulted in little progress.

Taiwan’s Efforts to Reduce its Economic Dependence on China Accelerates

After 2018, the global economy experienced a series of challenges, including the U.S.-China trade war, the U.S. Export Administration Regulations (EAR) and the COVID-19 pandemic, forcing a reallocation of the supply chain. Additionally, when the Chinese government adopted a “wolf warrior” strategy and economic coercion, China demonstrated again that it is a non-market economy (NME). Therefore, foreign firms accelerated their shift from China to Taiwan, Southeast Asian and South Asian countries. Many Taiwanese overseas firms also chose to move back to Taiwan; the “Action Plan for Welcoming Overseas Taiwanese Businesses to Return to Invest in Taiwan” has attracted NT$1.0401 trillion in investment since 2019. The investment to China from Taiwan, meanwhile, declined sharply to US$4.792 billion in November 2021 from US$9.671 billion in 2016. Inward and outbound investment numbers show that Taiwan is speeding up in reducing its economic dependence on China.

Taiwanese Exports at a Record High

The major factor facilitating the decision by Taiwanese firms to leave China is that the attitude of the U.S. government toward China has changed. In order to avoid the leaking of sensitive technology and to protect intellectual property rights, the U.S. government has been trying to establish a Resilient Supply Chain and has sought to ensure its economic security. For this purpose, the subcontractor supply chain of major U.S. brands should be compliant with the requirements of the U.S. government. This is the major reason why investment by overseas Taiwanese in Taiwan has increased sharply. Because investment in the Information and Communications Technology (ICT) sector in Taiwan has increased, production and exports in the ICT industry have also continued to grow. According to the Summary of Exports and Imports for December 2021, “In 2021, total exports expanded 29.4% and total imports rose by 33.2% compared with 2020. The trade balance of this year was favorable, amounting to US$ 65.28 billion.” Exports by firms in Taiwan have recently been at a record high.

Taiwan Invests More in Southeast Asia and Reduces Investments in China

In addition to investing in Taiwan, Taiwanese firms have put greater emphasis on investing in Southeast and South Asian countries, such as Vietnam and India. This is because developing countries have been trying to establish a new supply chain to help reduce economic dependence on China. Beside China, Southeast and South Asian countries also have huge demographic dividends; therefore, labor-intensive subcontractors will choose Vietnam or India, for example, as alternative manufacturing bases. Since 2017, total outbound investment to southeast Asian countries has been US$3,023 (2017), US$1,802(2018), US$2,404 (2019), US$2,663 (2020), and US$5,640 (2021) million. Singapore, Vietnam, Thailand and Indonesia were the top four Southeast and South Asian countries for outbound investment in 2021. Regarding Taiwanese exports to Southeast Asian countries in 2021, exports —including to countries under the New Southbound Policy — grew 35.2% from the previous year and higher than to China (25%). From the above statistics, it is clear that Taiwanese firms are reducing their outward investment to China and raising the investment to Southeast Asian countries.

Future Trends of Taiwanese Outward Investments

As China experiences its third-slowest growth performance in 2022 since its economy first started taking off in the late 1970s, the U.S.-China decoupling in the supply chains must lead to a restructuring of the China-centered production model adopted by Taiwanese businesses. Even if both the “dual-circulation” strategy and enhancing innovation constitute the core of this five-year plan, the big trend of supply chain restructuring will make this five-year plan fail. The above expectation will force more foreign manufacturers to leave China and create great unemployment. In addition to investing in Taiwan and Southeast and South Asian countries, for Taiwanese firms, the future development of Taiwan’s outbound investment will diversify to more developed countries. This is largely due to the great interest that the U.S., Japan and EU countries have paid to the semiconductor industry. Although they want to boost their chip industry and reduce their dependence on Taiwan supplies, they still need the investment of the Taiwanese semiconductor industry. Because investments in the entire semiconductor supply chain is huge, the outward investment to developed countries will obviously increase.

(Dr. Tsai is Professor, Department of Industrial Economics, Tamkang University)

Editor’s Note: The views expressed in this publication are those of the authors and do not necessarily reflect the policy or the position of the Prospect Foundation.