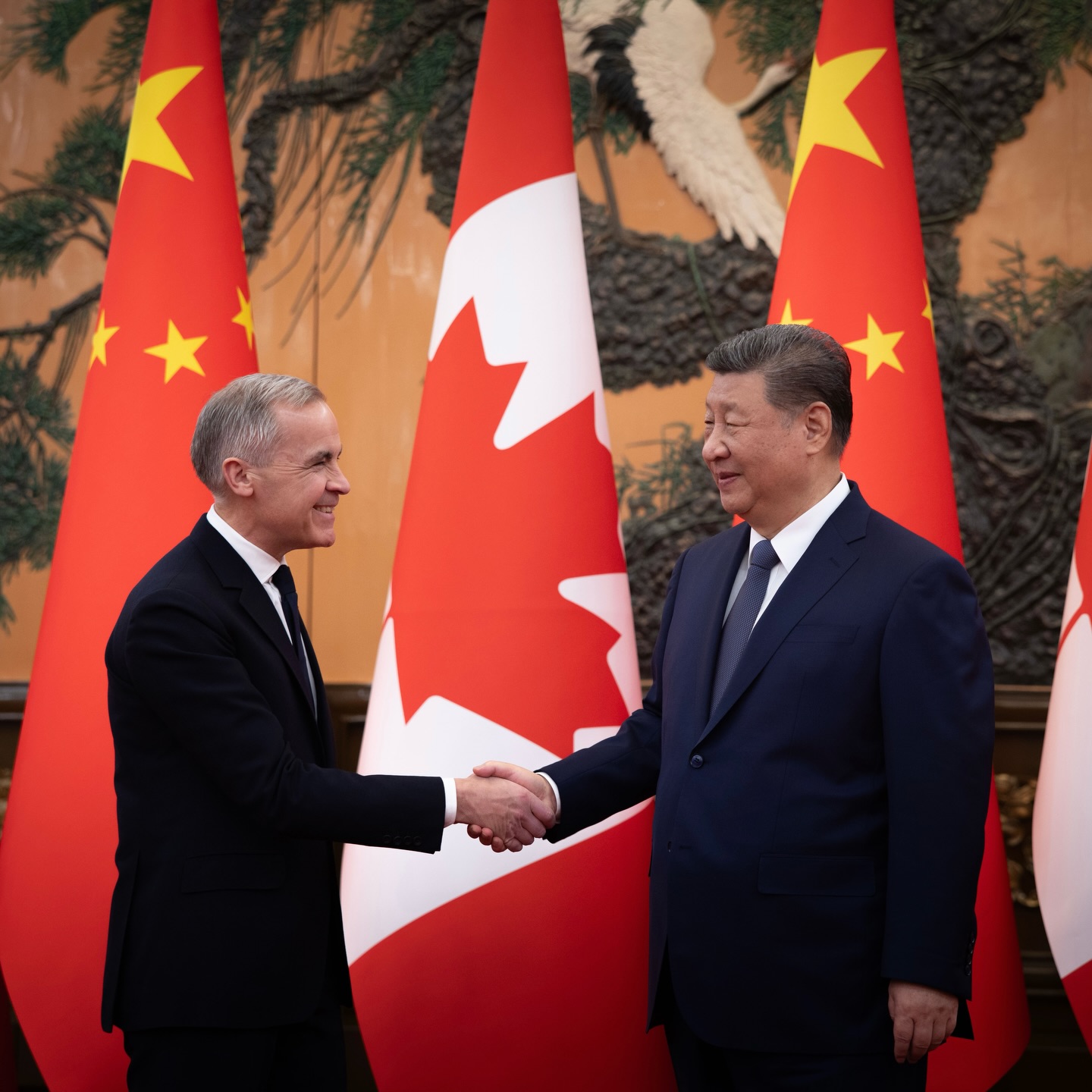

China has weaponized economics to influence Taiwan’s politics in recent years. Given the global trend of supply chain diversification, long-term cross-Strait trade prospects seem increasingly divergent, with the accelerated separation of supply chains as a critical indicator. Picture source: Depositphotos.

Prospects & Perspectives No. 1

The Impact of China’s Suspension of the ECFA on Cross-Strait Relations

By Chia-Hsuan Wu

Since 2021, China has been unilaterally imposing various trade restrictions on the import of goods from Taiwan, starting with agricultural and fishery products like pork, pineapples, sugar apples, and wax apples. Then, on April 12, 2023, China’s Ministry of Commerce suddenly launched an investigation against Taiwan for alleged trade barriers. This investigation came in reaction to Taiwan prohibiting the import of 2,455 Chinese items, including agricultural goods, minerals, chemicals, textiles, and more. Consequently, China accused Taiwan’s import restrictions of erecting trade barriers against China, negatively affecting exports from relevant Chinese industries.

On December 15, 2023, China’s Ministry of Commerce announced that Taiwan was persistently creating trade barriers against China. Following this, on December 21, China’s State Council’s Customs Tariff Commission stated that Taiwan was unfairly blocking exports of Chinese products, violating the rules of the Economic Cooperation Framework Agreement (ECFA). As a result, China decided to halt tariff discounts on some products listed in the ECFA’s Early Harvest program from January 1, 2024. The disclosed list includes 12 product types, mainly petrochemicals like propylene and paraxylene.

The recent series of actions by China, undoubtedly aimed to influence Taiwan’s 2024 presidential election, compounds existing strains on economic and trade ties between the two sides. This is because the ECFA framework has been a basis for cross-Strait economic and trade discussions. Though progress stalled on the Trade in Goods and Trade in Services Agreements, partly for political reasons and public opposition, the ECFA still plays a vital role in driving economic and trade interactions across the strait. Thus, China suspending some ECFA preferential treatments will likely have significant ripple effects on the overall cross-Strait situation.

However, in recent years the cross-Strait trade structure and dynamics have shifted considerably. After the COVID-19 pandemic, China experienced an economic downturn, reducing its import demand. Furthermore, amid U.S.-China trade conflicts, China has been actively pursuing self-reliance in supply chains by substituting imports with domestic products. This push for import substitution has gradually diminished the advantages of the ECFA. Consequently, halting certain ECFA preferences will have a much less significant impact than it might have had in the past.

Moreover, China’s export markets have seen a recent geographical shift. Influenced by democratic countries’ policies, China’s trade share with major traditional partners like the United States and Japan is declining. In contrast, trade is growing with regions such as ASEAN, Russia, and the EU. Notably, ASEAN has come out as China’s most vital trading partner. This redirection shows a strategic adjustment of China’s trade focus in response to global political and economic trends.

To cope with intense international decoupling pressure, China aims to champion indigenous innovation in science and technology, ensuring its critical industries not dependent on or constrained by foreign countries. In recent years, remarkable export performance has been seen in China’s three emerging products — the “New Three,” including electric vehicles, lithium batteries, and solar cells. The “New Three” are gradually approaching the status of the traditional “Old Three” exports — apparel, home appliances, and furniture. This shift shows China’s concerted effort to increase self-reliance as a countermeasure to Western containment strategies. Under the “New Three,” most supply chains domestically source components, reflecting China’s pursuit of self-reliance and supply chain autonomy.

It is vital to recognize that as China advances supply chain self-reliance, Taiwanese firms are losing their competitive edge. For instance, BYD, a Chinese electric vehicle manufacturer, has successfully set up control over electric vehicles’ three critical components and subsystems in pursuing autonomy: batteries, motors, and electronic controls. A UBS Securities study highlighted that over 70% of the parts in BYD’s new energy vehicles are produced internally. Furthermore, at the same production level in Shanghai, the total cost of these vehicles is approximately 15% lower than the Tesla Model 3s. This example underlines that as China’s supply chain becomes more self-reliant, foreign suppliers, including Taiwanese ones, are becoming less integral to meeting China’s intermediate product needs.

In the short term, without a significant shift in the political climate across the Taiwan Strait after Taiwan’s 2024 presidential election, it seems likely that economic and trade relations will continue to deteriorate. Following its trade barrier investigation, China has already suspended ECFA tariff preferences on 12 petrochemicals, potentially extending to other early-harvest items. As a result of these developments, both sides are taking a closer look at the ECFA’s value proposition. Furthermore, China’s sanctions seem poised to seriously affect advancing cooperation on trade and the economy between the two.

Eventually, the overarching factor influencing cross-Strait relations remains tensions in the U.S.-China relationship. The intensifying technological competition between the U.S. and China is pushing China toward an “internal circulation” strategy, redoubling efforts to develop domestic supply chains. This strategy aims to reduce reliance on imported products and mitigate the risk of technological sanctions. Consequently, Taiwanese firms in China will face a critical juncture with two primary paths:

Some Taiwanese firms may deepen their China investments to keep market access. These firms may focus on the Chinese domestic market, potentially integrating into China’s “red supply chain” or forming joint ventures with Chinese firms. This transformation may redefine these entities as “new mainland firms” or “mixed Taiwanese-mainland firms,” posing a challenge for the Taiwanese government in guiding and managing the new entities, especially concerning personnel and finances. Conversely, considering the Chinese market’s high risks, other Taiwanese firms may accelerate relocating or diversifying into other markets, gradually moving away from the Chinese supply chains.

In summary, China has weaponized economics to influence Taiwan’s politics in recent years. While local Chinese governments, especially in Fujian, continue proposing various integrative policies, the decisive factor remains the political climate across the Taiwan Strait. Given the global trend of supply chain diversification, long-term cross-Strait trade prospects seem increasingly divergent, with the accelerated separation of supply chains as a critical indicator.

Looking ahead, cross-Strait economic and trade relations are approaching a major inflection point. The traditional “triangular trade” model risks disintegration. Taiwanese firms will likely adopt more fragmented, “short-chained” strategies to reconfigure operations and navigate intensifying complexity and uncertainty in this evolving landscape. This strategic shift reflects adaptation to changing international trade and geopolitical dynamics.

(Dr. Wu is Associate Research Fellow and Deputy Director, Mainland China Division, Chung-Hua Institution for Economic Research.)