How the Collapse of Evergrande Real Estate Sparked an Economic Crisis in China

If the possibility of a default on loans by China Evergrande Group continues to increase, it could lead to negative consumer behavior on the real estate market and force householders to undersell houses. The behavior of householders will in turn result in more defaulting by real estate property developers. Put differently, the housing bubble in the Chinese economy will collapse.

Prospects & Perspectives 2021 No. 53

How the Collapse of Evergrande Real Estate Sparked an Economic Crisis in China

October 25, 2021

Since 2018, the global economy has experienced a series of challenges, from the US-China trade war and the US Export Administration Regulations to the COVID-19 pandemic, the reallocation of the supply chain and China’s electric power crunch. The above developments continue to disturb international trade. Because China plays an important role in manufacturing for the world market, we can expect that the above events will hurt China’s economy more than other countries. The big shock from the outbreak of the COVID-19 virus hit the Chinese economy and world economy more than the US-China trade war. Because both events appear to be beyond the Chinese government’s control, they risk propelling China’s economy toward a hard landing. As a result, firms in China’s domestic market will suffer severely. In China, the real estate sector is a major engine to drive domestic demand and further increase Gross Domestic Product (GDP), so the real estate property industry is an important indicator in watching the Chinese economy.

China Evergrande Group Under Financial Threat

Recently, the real estate property developer China Evergrande Group has faced an emerging financial threat and could go bankrupt. There has been much speculation as to whether the group’s financial troubles could trigger a broader crisis.

The People’s Bank of China and the Ministry of Housing announced new financing rules for real estate companies in 2020. Real estate property developers wanting to refinance are being assessed against three thresholds: (1) a 70% ceiling on liabilities to assets, excluding advance proceeds from projects sold on contract; (2) a 100% cap on net debt to equity; and (3) a cash to short-term borrowing ratio of at least one.

The purpose of the above three thresholds is to reduce a housing bubble risk. The China Evergrande Group cannot satisfy these financial requirements, and as such, the financial condition of Evergrande may not easily recover. The group could go bankrupt if it cannot receive sufficient financial support from the government or other private firms. Many people have also discussed whether the financial threat created by China Evergrande Group could be similar to Lehman Brothers, the investment bank whose failure in 2008 helped turn a US housing crisis into the worse economic disaster since the Great Depression.

Comparisons between China Evergrande Group and Lehman Brothers only go so far, however. China Evergrande Group is a real estate property developer while Lehman Brothers was an investment bank. The financial threat facing China Evergrande Group was expected, while the default of financial derivatives issued by Lehman Brothers was not. As a result, the damage to the global economy caused by China Evergrande Group and Lehman Brothers should be very different. That being said, the accuracy of the official financial data could affect assessments of the impact of China Evergrande Group’s financial travails on the global economy.

Evergrande: Warnings of a Housing Bubble in the Chinese Economy

The emerging financial threat posed by China Evergrande Group has led analysts to focus on how this financial threat will affect the overall Chinese economy. China Evergrande is the largest company in the real estate market, with liabilities close to US$300 billion. In general, a real estate property developer needs to cooperate with many subcontractors to provide houses and housing services. In other words, firms involved in the real estate industry’s supply chain are numerous. The accounts receivable between real estate property developers are usually complicated. Once the liability of a large real estate property developer have a high likelihood of default, it will trigger a domino effect in the real estate industry and the related creditor bank will incur huge bad debt expenses. Further, some small and medium subcontractors will first go bankrupt and have a negative effect on the labor market. The negative impact of huge bad debt expense on labor market depends on the loan scale of a real estate property developer. In the case of China Evergrande Group, the default on loans will cause a huge shock to the labor market and, in turn, decrease domestic demand in China.

China Evergrande Group Could Destroy the “Dual-Circulation” Strategy

The “dual-circulation” strategy is the core of China’s 19th five-year plan for economic, environment and social development. This strategy includes both “great international circulation” and “great domestic circulation.” The 19th five-year plan puts special emphasis on the importance of great domestic circulation in the next generation of China’s big economic policies. The export sectors are still an important source of revenue for many firms, and therefore one of the “dual-circulation” strategy is to keep China open to the world (the “great international circulation”), while strengthening the domestic market.

As a result, if the possibility of a default on loans by China Evergrande Group continues to increase, it could lead to negative consumer behavior on the real estate market and force householders to undersell houses. The behavior of householders will in turn result in more defaulting by real estate property developers. Put differently, the housing bubble in the Chinese economy will collapse. In this case, the business environment will worsen and foreign direct investment (FDI) will decrease. Finally, the promise of a “dual-circulation” strategy will not be realized and, again, so will concerns about whether the Chinese economy is headed for a hard landing.

Will China Save Evergrande?

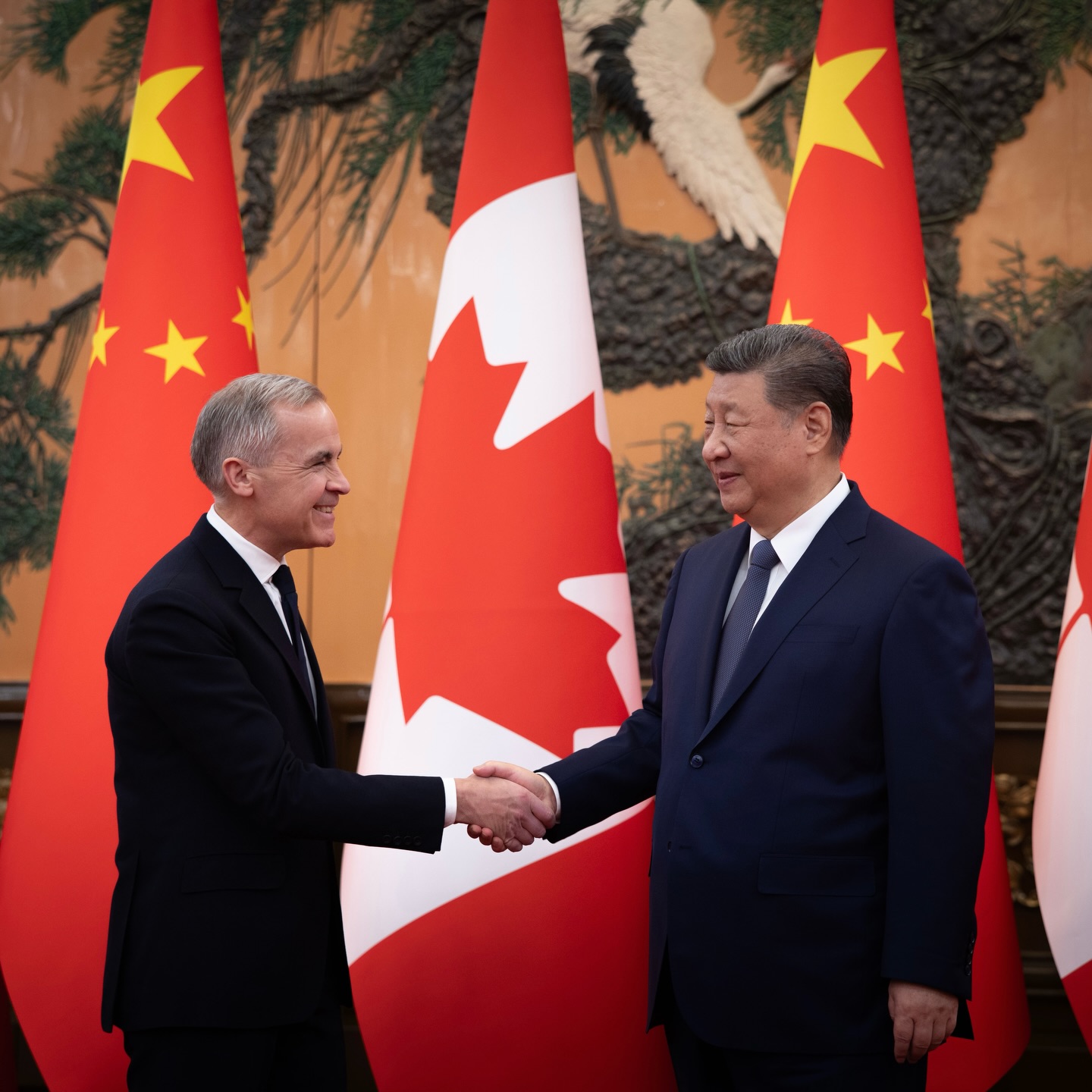

As we have seen above, the financial crisis that has beset China Evergrande Group is generating greater uncertainty for the Chinese economy, with fears that it could spin out of control. Under the “common prosperity” principle, President Xi Jinping could decide to protect China Evergrande Group’s clients by underwriting the contract between Evergrande Group and its clients. However, Xi will not help to solve the other financial troubles between Evergrande Group and its subcontractors or overseas debt issued by the group.

(Dr. Tsai is Professor, Department of Industrial Economics, Tamkang University.)